Business vehicle depreciation calculator

Heres an easy to use calculator that will help you estimate your tax savings. 3000 500 1500 5000 Your total mileage was 18000 and documented.

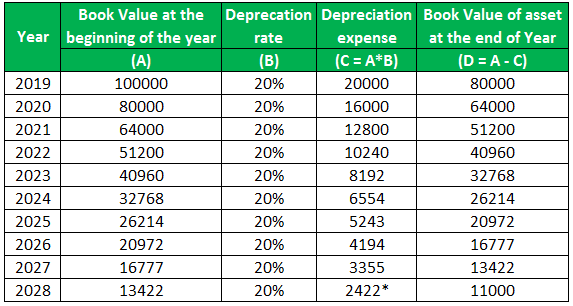

Depreciation Formula Calculate Depreciation Expense

The limits of the depreciation deduction including section 179 expense deductions for luxury automobiles placed in service in 2021 for which bonus depreciation is.

. First enter the basis of an asset and then enter the business-use percentage Next select an applicable recovery period of property from the dropdown list Next choose your preferred. Simply enter in the purchase price of your equipment andor software and let the calculator take care of the rest. If you enter 100000 for basis and business use is 80 then the basis for depreciation adjusted basis is 80000.

Use this free car depreciation calculator to get an idea of how much your car could be valued at and how much it will likely depreciate over the years. If the business use on your vehicle is under 50 youre required to use the straight-line depreciation method SLD instead. A car that doesnt depreciate as much will save you more money than one that costs a little less to fill up and lasts longer between refuels.

Tax provisions accelerate depreciation on qualifying business equipment office furniture technology software and other business items. Alternatively if you use the actual cost method you may take deductions for. The calculator makes this calculation of course Asset Being Depreciated -.

The tool includes updates to reflect tax depreciation. If its an old car there is no depreciation write-off. Your total actual expenses were 5000.

You can generally figure the amount of your deductible car expense by using one of two methods. This tool is available to work out the depreciation of capital allowance and capital works for both individual and businesses taxpayers. Enter the purchase price of a business asset the likely sales price and how long you will use the asset to.

To calculate the impact of depreciation compare an example for a commercial truck worth 100000. Enter the purchase price of a business asset the likely sales price and how long you will use the asset to compute the annual rate of depreciation of that asset or piece of equipment. Depreciation formula The Car Depreciation.

The total number of units that the asset can produce. Business vehicle depreciation calculator Friday September 2 2022 Edit. Depreciation per year Asset Cost - Salvage.

SLD is easy to calculate because it simply takes the. If you qualify to use both. Again this isnt a.

Assume a depreciation rate of 30 after the first year and 20 each. With this method the depreciation is expressed by the total number of units produced vs. The standard mileage rate method or the actual expense method.

The 2022 standard mileage rate is 585 cents per mile and for 2021 is 56 cents per mile for business. If a vehicle is used 50 or less for business purposes you must use the straight-line method to calculate depreciation deductions instead of the percentages listed above.

Depreciation Schedule Template For Straight Line And Declining Balance

Car Depreciation Rate And Idv Calculator Mintwise

Free Macrs Depreciation Calculator For Excel

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Car Depreciation Calculator

Depreciation Calculator

Annual Depreciation Of A New Car Find The Future Value Youtube

Depreciation Of Vehicles Atotaxrates Info

.png)

Car Depreciation For Taxes The Ultimate Guide Keeper Tax

Depreciation Calculator Depreciation Of An Asset Car Property

Depreciation Rate Formula Examples How To Calculate

Macrs Depreciation Calculator With Formula Nerd Counter

Depreciation Formula Calculate Depreciation Expense

Car Depreciation Calculator Calculate Straightline Reducing Balance Automobile Depreciation Rates Vehicle Values

Download Depreciation Calculator Excel Template Exceldatapro

Macrs Depreciation Calculator Irs Publication 946

Macrs Depreciation Calculator Irs Publication 946