Find rate of depreciation

Section 179 deduction dollar limits. At the end of the useful life of the.

How To Calculate Depreciation Youtube

The Calculate Depreciation batch job calculates a straight-line amount and a declining balance amount but only the greater of the two amounts is transferred to the journal.

. Year 1 2 x 10 x 250000 INR 50000 Year 2 2 x 10 x 250000-5000 INR 40000 Year 3. Thus at the end of 2019 the accumulated depreciation is 14250 4750 3 and the depreciated cost is 95750 110000 14250. Definitions and Meaning of depreciation rate in English depreciation rate noun.

After a year your cars value decreases to 81 of the initial value. The rate at which the value of property is reduced. Depreciation rate finder and calculator You can use this tool to.

Let us discuss how to find the uniform rate of depreciation using the principle of compound interest in detail in the below modules. Used to calculate tax deduction. After two years your cars value.

Ad Expertly Manage the Largest Expenditure on the Balance Sheet with Efficiency Confidence. The value of a machine is estimated to be 27000 at the end of 1994 and 21870 at the beginning of 1997. Find the depreciation rate for a business asset calculate depreciation for a business asset using either the diminishing value.

Depreciation Amount Asset Value x Annual Percentage. Supposing it depreciates at a constant rate per year of its value at the. The most common depreciation is called straight-line depreciation taking the same amount of depreciation in each year of the assets useful life.

Multiply the rate of depreciation by the beginning book value to determine the expense for that year. For example 25000 x 25 6250 depreciation expense. To get the depreciation cost of each hour we divide the book value over the units of production expected from the asset.

The car depreciation rate depends on the age of the car its mileage and the below depreciation table. Car Age 1 year 2 years. SLM depreciation rate 110 10 Double declining balance depreciation.

This limit is reduced by the amount by which the cost of. Percentage Depreciation Calculator Asset Value Percentage Period Results The calculator uses the following formulae. Depreciation is calculated using the formula given below Depreciation Asset Cost Residual Value Life-Time Production Units Produced For Year 1 Depreciation 350 million 020.

Our car depreciation calculator uses the following values source. For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000. 9500 100000 0095 So thats an hourly depreciation.

Need an Easy Accurate Way to Comply with State Depreciation Across Multiple States. For example the first-year. Car Age 2 years 3 years.

Straight Line Depreciation Formula And Calculator

Depreciation Formula Calculate Depreciation Expense

Depreciation Rate Formula Examples How To Calculate

Declining Balance Depreciation Calculator

Depreciation Rate Formula Examples How To Calculate

Depreciation Of Car Word Problem Solution Youtube

Depreciation Formula Calculate Depreciation Expense

Ex Find Annual Depreciation Rate Given F T Ae Kt Youtube

Annual Depreciation Of A New Car Find The Future Value Youtube

Depreciation Calculator Definition Formula

How To Use The Excel Amorlinc Function Exceljet

How To Use The Excel Db Function Exceljet

Depreciation Rate Formula Examples How To Calculate

Depreciation Calculation

Ex Find Annual Depreciation Rate Given F T Ae Kt Youtube

How To Calculate The Depreciation Of Currency Accounting Education

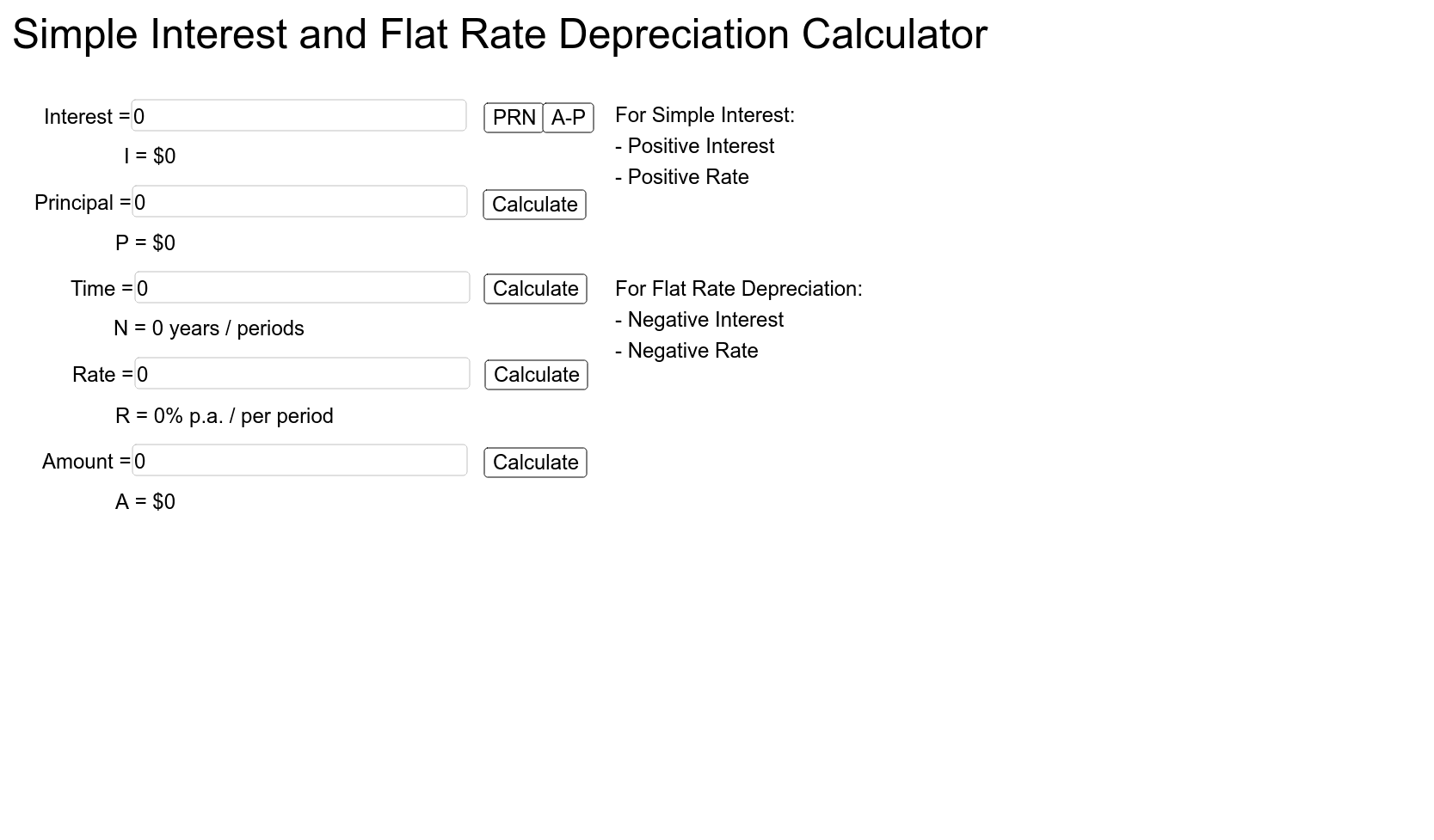

Simple Interest And Flat Rate Depreciation Calculator Geogebra